how to avoid inheritance tax in florida

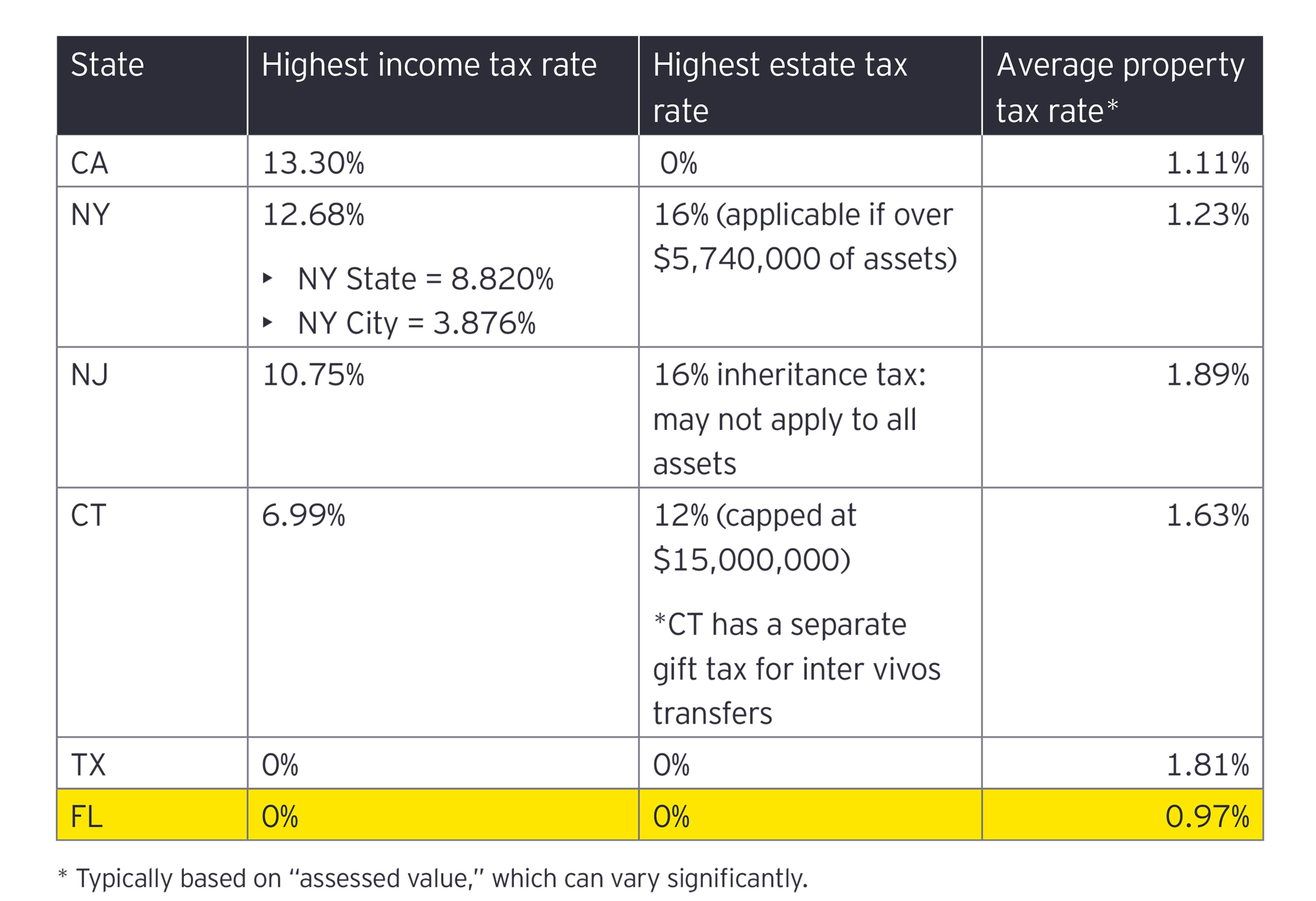

Florida Inheritance Tax and Gift Tax. The estate tax exemption is adjusted for inflation every year.

Legal Advice To Avoid Taxes On Inheritance

This tax is different from the inheritance tax which is levied on money after it has been passed on to the deceaseds heirs.

. 2 Give money to family members and friends. 3 Leave money to charity. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Convert your IRA to a Roth. Federal Estate Tax. Property with right of survivorship.

The size of the estate tax exemption means very. To be subject to inheritance tax someone either inherits assets from a person who lived in a state with the tax or inherited property located in a state with the tax. It happens if the inherited estate exceeds the Federal Estate Tax exemption of 1206 million.

Give away some of the money. Florida Inheritance Tax Beginner S Guide Alper Law However if you want to avoid the risks associated with an inheritance loan you may want to consider an inheritance advance. Property held in trust.

Assets that can avoid probate typically include. Having multiple partners take ownership of. In addition to helping those in.

It allows the states residents who have a sufficient estate to reduce its taxable part legally without any adverse fiscal side effects. The Federal government imposes an estate tax which begins at a whopping. 1- Make a gift to your partner or spouse.

If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount. Life insurance policy proceeds. In the event of your death the assets wont be part of your estate.

Florida residents are fortunate in. Arizona also does not have a gift tax. The federal estate tax exemption for 2021 is 117 million.

The internal revenue service announced today the official estate and gift tax limits for 2021. Create an irrevocable trust and transfer your assets into the trust to avoid paying estate taxes. Pay the PA inheritance tax early.

How to avoid inheritance tax in florida. An estate tax is imposed on the property before it is being transferred to heirs. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. It may seem counter-intuitive but sometimes it makes sense to give a portion of your inheritance to others. 15 best ways to avoid inheritance tax in 2020.

Put everything into a trust.

2022 State Business Tax Climate Index Tax Foundation

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

How To Avoid Probate In Florida Legal Guide Alper Law

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Does Florida Have An Inheritance Tax

Does Florida Have An Inheritance Tax Doane And Doane P A

How To Avoid Estate Taxes With A Trust

5 Legal Tax Shelters Anyone Can Use

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

10 Ways To Reduce Estate Taxes Findlaw

/cdn.vox-cdn.com/uploads/chorus_asset/file/22363424/210308_fciccolella_voxmedia_inheritance_secondaryillustration.jpg)

How Inheritance Became A Gift A Necessity And A Curse Vox

President Trump Changes Residence To Florida Primarily For Tax Purposes Report Salon Com

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation